Despite the ongoing bear market, we have seen cryptocurrencies offer higher ROIs than other asset classes. Maybe this is why many investors are forgoing other traditional investment options. Since the crypto market never stops, it is highly likely that their values rise and fall within a few seconds. Given this high volatility, many crypto investors are considering investing in stablecoins like Tether (USDT), USD Coin (USDC), and others.

What are Stablecoins?

A majority of the prominent stablecoins are basically tokens based on the Ethereum blockchain. They are safe to invest in since their prices rarely fluctuate. Even their fluctuation is capped at approximately 2%. Hence, investors wanting to explore the crypto market may take advantage of stablecoins.

The Need for Stablecoins

Stablecoins are mostly used to buy or sell cryptocurrency easily, thereby avoiding the need to use fiat currencies. Investors may benefit from trading their cryptocurrencies for stablecoins in case of falling prices, thereby maintaining their portfolio without incurring any losses. They are also a trustworthy way for crypto investors to stay put in the crypto market at a lower risk. This makes them a viable option for crypto payments.

How do Stablecoins Work?

Stablecoins work like any other cryptocurrency. They exist on a blockchain and can be traded from one digital wallet to another. But this is why the similarity ends. Unlike other cryptocurrencies, stablecoins are actually backed by a ratio of 1:1 to other assets. These backed assets can be fiat currencies like the US Dollar, the Euro, legal bonds, or even commodities traded on exchanges.

In order to maintain a comparatively stable value, stablecoins employ a number of mechanisms. Pegging the stablecoin to a particular asset or group of assets, like the US dollar, is one of the most popular mechanisms. As an illustration, to guarantee that each stablecoin can be exchanged for its equivalent value in US dollars at any time, the issuer may keep one dollar in a reserve account for each stablecoin it issues. This is also called a collateralized stablecoin.

Algorithmic stability is another mechanism that stablecoins use. It entails using smart contracts and other algorithms to modify the supply of stablecoins in accordance with market demand. The smart contract may create new stablecoins to increase the supply and bring the price back down if the stablecoin’s price exceeds its pegged value. The smart contract may burn existing stablecoins to reduce supply and raise the price if the price drops below its pegged value.

Additionally, stablecoins may be backed by other cryptocurrencies or goods like gold, silver, or oil. The backing asset gives the stablecoin’s value stability because it has a less volatile price than other cryptocurrencies.

Types of Stablecoins

- Fiat-Backed Stablecoins: These stablecoins have a 1:1 relationship with real-world currencies like the US dollar or the euro. The stablecoin’s issuer keeps the equivalent sum of the fiat money in a reserve account, ensuring that the stablecoin can always be redeemed for the equivalent amount of fiat money.

- Commodity-backed Stablecoins: These stablecoins are supported by precious metals, real estate, or other commodities like gold. The stablecoin is backed by a supply of the commodity, and its value is correlated with that of the commodity.

- Crypto-Backed Stablecoins: To guarantee their stability, these stablecoins use one or more cryptocurrencies as collateral. In order to issue the stablecoin, a reserve of cryptocurrencies, like Bitcoin or Ethereum, is used as collateral. The collateral is sold in order to keep the stablecoin stable in the event that its value falls below a specific level.

- Algorithmic Stablecoins: These stablecoins use algorithms to manage their supply and achieve market stability. To maintain a stable price, the algorithm modifies the stablecoin’s supply based on market demand. The algorithm may create new stablecoins to increase the supply and bring the price back down if the stablecoin price exceeds its pegged value. Existing stablecoins may be burned by the algorithm to reduce supply and raise the price if the price drops below its pegged value.

Advantages of Stablecoins

- Low volatility – As mentioned, because its underlying assets are stable and limit price fluctuations, this type of coin is less volatile than other cryptocurrencies.

- Increased transparency – Users can more easily track and trace transactions with cryptocurrencies than with traditional currencies, which are decentralized networks bound to particular governmental systems.

- Reduced risk – Because there is less reliance on centralized governments or banks to regulate them, there is significantly less chance of losing money as a result of loan defaults or poor financial management.

Latest Developments

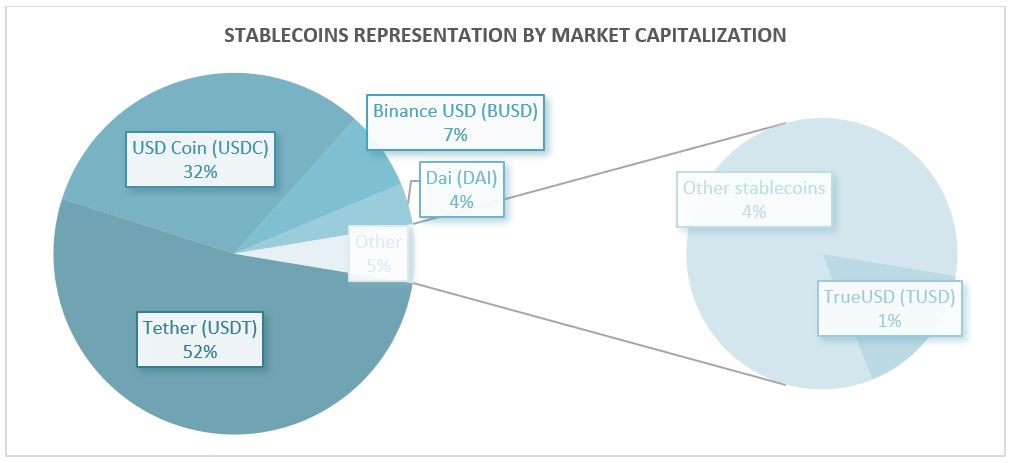

Here is a chart for market cap of the five largest stablecoins as compared to others. Tether (USDT) and USD Coin (USDC) lead the stablecoin market by both, capitalization and trading volume.

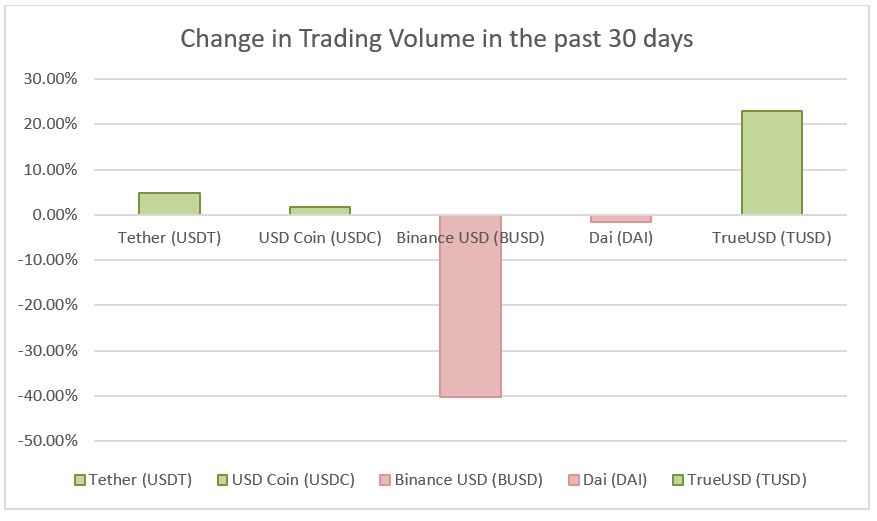

Between the period February 2nd 2023 to March 3rd, 2023, these are the changes noticed within the top five stablecoins –

Below are the other developments in the field of stablecoins:

- As stablecoins gain popularity and adoption, regulators are keeping a closer eye on any potential effects they may have on monetary stability and consumer safety. To address these issues, a number of nations, including the US, have suggested or put into effect stablecoin regulations.

To conclude, stablecoins are a significant advancement in the world of cryptocurrencies and blockchain technology, to sum up. They offer the stability and predictability necessary to build a strong and long-lasting ecosystem for digital assets. According to user demands and market conditions, the various stablecoin types—including fiat-backed, commodity-backed, crypto-backed, and algorithmic stablecoins—offer a variety of advantages and use cases. Stablecoins are gaining importance as a tool for securely and reliably facilitating transactions and investments as more and more organizations and individuals realize the potential of blockchain and cryptocurrencies.