Cryptocurrencies are volatile and their price tends to fluctuate on a real-time basis. But stablecoins share many powers of other cryptos minus the volatility – the reason for their increasing acceptance.

We are all witnessing history being made in the Crypto industry. There has been major adoption by individuals and institutions to support blockchain technology to revolutionize industries such as finance, health, energy, crowdfunding, payments, and real estate, etc. Different coins and tokens have different utilities and can co-exist within the digital ecosystem to make storing and trading a smooth experience.

Need For Stablecoins

Cryptocurrencies tend to fluctuate due to several factors such as market speculations, during a bull run, a bear market, or a crash. With such volatility that could occur at any time, investors were looking for a quick exit plan to protect their investments from a further drop and reduce their losses. This purpose was solved by “Crypto Stablecoins”.

Also read: Green Crypto: Is Proof Of Stake Answer To Cryptocurrencies’ Energy Worries?

What Is A StableCoin?

Unlike Bitcoin or Ethereum, a stablecoin is a type of cryptocurrency whose value is pegged to a non-digital asset, such as the U.S. dollar, or gold, to stabilize the price. As it is pegged, stablecoins are able to combat the price volatility experienced by cryptocurrencies like bitcoin or Ether.

The most popular stablecoins in circulation are Tether (USDT) and True USD (TUSD) with a stable rate of 1 Tether/True USD = $1 and are both fiat-backed coins. The most common use of stablecoins is during trading. Suppose the bitcoin price is currently at $30,000 and the market is leaning towards bearish signals and the bitcoin price starts to drop. Users on exchanges could trade the bitcoin to Tether at $30,000 before the expected drop, which could reach $27,000 and then rebuy bitcoin at a cheaper rate of $27,000 or simply cash out at $30,000.

uOWN Tokens: How it works

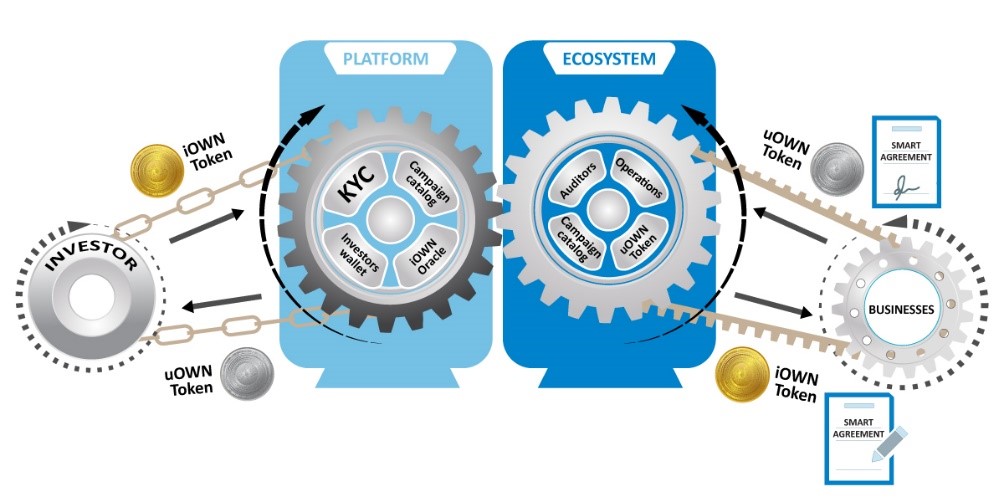

In the iOWNX ecosystem, two tokens make the system work: the iOWN Token which is utilized to fund business for return equity on the crowdfunding platform (iOWNX). The token itself fluctuates as its price depends on supply and demand and has a max supply of 450M Tokens. For the iOWNX ecosystem to function and execute the funding of a specific business, the delivery of the service outcomes to users will be in the form of uOWN Tokens and smart agreements.

The uOWN Tokens, similar to stablecoins, will always have a fixed value. The uOWN Token is a passive, non-transferable, unlimited supply token that does not have tradable API keys, unlike stable coins. uOWN Tokens are stable coins that are issued and governed by the iOWN ecosystem and represent the rights to receive revenue from a business campaign.

The uOWN Tokens will be accessible through a proxy allowing supervision from iOWNX Platform and confirmations from the business when necessary, thus users cannot transfer their tokens to other investors who haven’t completed KYC, AML, and other processes which make them eligible to participate in the campaigns. The uOWN Token Smart Contract goes through different phases (generation, activation, maturity, and termination) representing different parts of the lifecycle and are co-signed as needed and when the business is matured it is evaluated and profit is distributed, investors confirm changes to the amount in uOWN Tokens as business posture or audit assessment changes.

Also read: Earn Passive Income From Cryptocurrency: 8 Ways To Know

The iOWNX Ecosystem generates agreements with businesses when a service is registered after a successful campaign. Agreements can be used to state: Campaign “C” is awarded to User “X” by iOWN Ecosystem “E” on behalf of Business “B” with iOWN Oracle “O” and uOWN Token “u” after which the address of this agreement can be used to activate the uOWN Tokens, thus giving access to the User Business service(s).

To conclude, for a solid crypto ecosystem to operate and function effectively, it requires several elements that work hand-in-hand to produce a seamless experience. Stablecoins work perfectly with more volatile coins within exchanges and the DeFi space, therefore you will most likely see them come in pairs such as Ethereum-USDT or iOWN -USDT. The same applies to the iOWNX ecosystem to function effectively, it requires several elements such as the iOWN Token, which is a token that has a value that changes based on supply and demand and is used to fund businesses on the iOWNX platform for the return of equity and the uOWN Token that represents the number of shares you own within the business you have invested in. These three core elements (iOWNX, iOWN Token, and uOWN Token) work together to ensure security and a great user experience protected by the Smart Contract.